Translate

Saturday, 16 January 2016

Thursday, 14 January 2016

Wednesday, 6 January 2016

Tuesday, 5 January 2016

Monday, 4 January 2016

Waves Reapeating - Bitcoin Price $2400 by June 2016

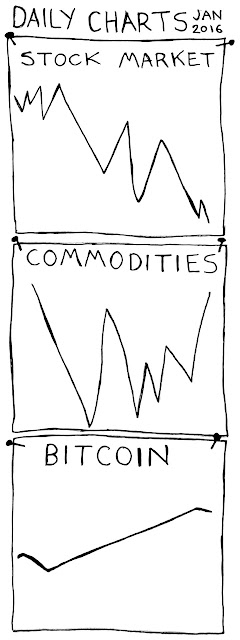

As the old stock markets have been shut down over the Christmas/New Year season there has been a lot of time for me to take a step back and look at the long term charts. For some time I have suspected a pattern in bitcoin boom waves, and i'm not alone on this. But until now I hadn't given it to much credence. Looking at the long term gold chart however has lead to this admittedly bazaar conclusion.

There's a similarity in these precious metal charts that seems to be giving guidance for the price of bitcoin. The "boom an wobble down to boom" pattern is repeated on different time scales. It maybe caused by some kind of psychological phenomenon in relation to safe havens for value and bubbles. I'm not sure why its doing this but it seems to be repeated at least 3 times in btc and twice in gold. Considering also that trading bots are looking for repeating patterns and make up a big part of the market, I was compelled to overlay the charts.

I wouldn't want to get all Nostradamus on it, but now is the season. I feel this level of market capitalisation is reasonable so in good faith I'll time stamp my prediction for the year in the blockchain.

"I, MidwayCrypto estimate a price of $2400 by mid 2016 followed by a dip to $1400 by year end"

Bitcoin

Gold

Silver

There's a similarity in these precious metal charts that seems to be giving guidance for the price of bitcoin. The "boom an wobble down to boom" pattern is repeated on different time scales. It maybe caused by some kind of psychological phenomenon in relation to safe havens for value and bubbles. I'm not sure why its doing this but it seems to be repeated at least 3 times in btc and twice in gold. Considering also that trading bots are looking for repeating patterns and make up a big part of the market, I was compelled to overlay the charts.

I wouldn't want to get all Nostradamus on it, but now is the season. I feel this level of market capitalisation is reasonable so in good faith I'll time stamp my prediction for the year in the blockchain.

"I, MidwayCrypto estimate a price of $2400 by mid 2016 followed by a dip to $1400 by year end"

Saturday, 2 January 2016

Segregated Witness - Endorsed by the Wu Tang Clan

There has been a new development in bitcoins scaling debate and its triggering a reddit battle rap. Whatever "segregated witness" is it seems to be holding ground in this hostile world. Those who are not familiar with programming and more with Wu Tang will like what they are getting here, more transactions. Understanding how it works is another thing.

The bitcoin improvement proposal increases the amount of transactions that bitcoin can process with out increasing the block size, something once considered impossible without a hard fork. It does this by folding transaction data into encrypted signatures. The result is increased transaction capacity by up to four times. Thats 28 transactions per second or around 2.4m per day.

There are auxiliary benefits to the proposal as well. It fixes long standing concerns about malleability and allows the existing block chain to be trimmed without compromising security. "SegWit" is also compatible with other scaling projects such as the lightning network and sidechains. It gives these systems more time to be fully dispersed and reduces the risk of a transaction bottleneck before they are fully utilised. It seems holding out on change, in this case, has paid off with more innovation.

Bitcoiners are having a decentralised block party on this and it shows in the price. It has been years in the making. Gregory Maxwell of the bitcoin "core" first floated the concept for testing at the Hong Kong scaling conference. Following that Pieter Wuille, another prominent bitcoin coder made a presentation streaming live on the 14th of December. The price of bitcoin rose by $15 that day to $460 USD. The proposal now has at least 31 signatures from the bitcoin core group, which is by far the most significant group of bitcoin coders, bitcoin gurus so to speak so far. There are now 50 signatures on a road map to have this implemented by April 2016 along with other measures.

Its not unanimous, people have come back and said that the SegWit code is ugly. They debate the idea of adding many lines of code to solve a solution that can be solved with just one line in the consensus code. Even though SegWit does not change the consensus code it may add complexity to the overall system and it is unclear what the repercussions of the change could be. The code in itself could be considered quite elegant or atrocious, judge for yourself. In the end it depends on your opinion of a hard fork. Increasing block size means that all bitcoin software needs to be updated to avoid major disruption to the system. SegWit doesn't require this simultaneous upgrading of nodes.

It's exciting to see such practical results and problem solving developing far a decentralised community. Segregated witness at the very least proves the ability of bitcoin and core developers to innovate and make wise decisions under pressure. An early change as proposed by Mike Yearn certainly seems foolish now. Group think concerns seem to have given way to the hive-mind. This is positive progress without a true leader. We will be watching this space into 2016 and eager to hear more. With some relief this could be the end of the argument and start of a new phase for bitcoin addoption.

"Can I get Segwitness to testify that we take care of business?"

Subscribe to:

Posts (Atom)