Translate

Thursday 21 December 2017

Reddcoin is the Bestcoin

Monday 4 December 2017

Bitcoins Net Neutrality Side Step

Whilst net nuetrality is debated and put under threat the bitcoin infrastructure has already set up viable alternatives to side step a potential shut down of the internet as we know it. Satellites are up and running. Short wave moon bouncing and blue tooth mesh networks are other viable options. With these maybe even shutting down the internet will not stop crypto currency.

Saturday 2 December 2017

Collecting your Byteball and Clams

Byteball was easy to download and figure out. It's a great app on your phone. the only problem for me is that my bitcoin is all spread out and I think supper secure, so its not easy to collect my bytballs. you want to have all your bitcoin in a just a few digital wallets to do it.

Clams clamed up my hard drive, I lost the shortcut after a crash, It wouldn't sinc, still haven't bothered to get it going yet. This is what it looks like. It's a core client re-skin.

I hope all the other bitcoin forks will be easier to get out otherwise I'm afraid we might end up autoholding because it takes to much effort and compromises too much security to cash out. I think that's bullish for bitcoin gold.

Clams clamed up my hard drive, I lost the shortcut after a crash, It wouldn't sinc, still haven't bothered to get it going yet. This is what it looks like. It's a core client re-skin.

I hope all the other bitcoin forks will be easier to get out otherwise I'm afraid we might end up autoholding because it takes to much effort and compromises too much security to cash out. I think that's bullish for bitcoin gold.

Governments of the Future - No More Oil Tycoons

Old wealth was traditionally last century controlled by the people who found oil. This century new wealth is with tech people. This is stepping up with people who found bitcoin, with people who can code computers and understand cryptocurrency. In a way, bitcoin and cryptocurrency is a continuation of the tech boom. The knowledge well and the wealth influence becoming more monetised. This is only the beginning and can bring a big cultural change in the world.

We should take some time to consider not only how bitcoin change the way this new wealth is stored, but the cultural impact on a society which could be ceding a significant amount of control to a new type of person. The young computer magicians rather than the landowners and frontier tycoons. Even though our countries are mostly democratic, wealth and tax collection have a big influence and this combination should have a large impact on the governments of the future.

As we have discussed briefly in previous posts, bitcoin cannot be taken by force. As first the difference here can seem subtle but it is important. Governments will have to collect tax from people who want to pay it rather than those who just feel implicated. They will not be able to easily force and confiscate payment so they will have to become more appealing. We will feel happy to provide funds for the common good.

I look forward to more solar panels and space travel, less pollution and war.

We should take some time to consider not only how bitcoin change the way this new wealth is stored, but the cultural impact on a society which could be ceding a significant amount of control to a new type of person. The young computer magicians rather than the landowners and frontier tycoons. Even though our countries are mostly democratic, wealth and tax collection have a big influence and this combination should have a large impact on the governments of the future.

As we have discussed briefly in previous posts, bitcoin cannot be taken by force. As first the difference here can seem subtle but it is important. Governments will have to collect tax from people who want to pay it rather than those who just feel implicated. They will not be able to easily force and confiscate payment so they will have to become more appealing. We will feel happy to provide funds for the common good.

I look forward to more solar panels and space travel, less pollution and war.

Tax Cuts and Escaping Government BS

Debt keeps rising whilst the US government debates tax cuts that might not even be tax cuts. Whatever it is all we can be sure of is that this bs will not be in our favour. If you use dollars you're supporting this ridiculous charade. And it's not just the US, it's happening all around the world, this fiat money is created unfairly out of nowhere.

But the good thing is we don't need to suffer this bs where banks and governments generate there own free money anymore. We have bitcoin. We have a choice. if you continue to use USD your value with the USD you are supporting Trump, the deep state, the military industrial complex, global warming, the wealth gap of the old financial system, you name it, pretty much anything bad. If you want to escape this all you need to do is choose to. Keep your value where it is respected. With the fiat debt clocks set start ticking at light speed who knows where the ceiling is.

But the good thing is we don't need to suffer this bs where banks and governments generate there own free money anymore. We have bitcoin. We have a choice. if you continue to use USD your value with the USD you are supporting Trump, the deep state, the military industrial complex, global warming, the wealth gap of the old financial system, you name it, pretty much anything bad. If you want to escape this all you need to do is choose to. Keep your value where it is respected. With the fiat debt clocks set start ticking at light speed who knows where the ceiling is.

Saturday 25 November 2017

Etherium Proves the Best Brains are in Bitcoin

With Etherium's slow, delayed and unimpressive releases of upgrades, it's becoming clear that all the best minds are in bitcoin. Trace Mayer puts it well when talking about programmers, bitcoin is where the Isaac Newtons of today, the polymaths are practising. Bitcoin core currently has over 1000 contributors 15000 repositories and 758000 commits on GitHub. Etherium has only 11 contributors.

The Second Grand Bitcoin Boom and Peak Media Hype

The Bitcoin price is booming, but at the moment it seems like many people don't realise the impact of what is going on. The media haven't really picked up on how good this is for the many bitcoin holders. We have passed $8000 USD!

Lots of people are getting rich and escaping the constraints of the existing financial system. A new popular term "crypto wealthy" describes people who have made millions in crypto currency but continue to hold it, rather than sell for cash or waste it on sometimes pointless luxuries like lambos. Andrew Desates described how many people in these circles are deciding to do non-traditional things with their new found security, like spending time with family and deciding to work on projects for good which they believe in.

Lots of people are getting rich and escaping the constraints of the existing financial system. A new popular term "crypto wealthy" describes people who have made millions in crypto currency but continue to hold it, rather than sell for cash or waste it on sometimes pointless luxuries like lambos. Andrew Desates described how many people in these circles are deciding to do non-traditional things with their new found security, like spending time with family and deciding to work on projects for good which they believe in.

Prediction judging the top, corrections and pull backs are common but i have a feeling that this boom won't even have started to the fullest until bitcoin, the lifestyle and the mindset is flashing in our faces and across everyone's old fashion TV screens.

Friday 24 November 2017

Bitcoin Peacecoin

Bitcoin doesn't fund war. I have not even heard of it being used for violence or cruelty in a single story. The supposed shady dark markets of early years seem distant and irrelevant especially in the context of celebrity scandals in politics and Hollywood like Harvey Weinstein storm and corporate corruption like JP Morgans new money laundering violation out of Switzerland.

Bitcoin seems more and more like a token of peace and a haven from all the toxic things in the world.

Bitcoin seems more and more like a token of peace and a haven from all the toxic things in the world.

Thursday 19 October 2017

WTF is OmiseGo? and Why ICO's are Trash

I was on the crypto market cap site the other day, as you do sometimes and noticed that it can sort by token. I'm not anti token or ICO. I've even raved about it before and created my own tokens on the bitcoin network, Zaks, Authenties, Jurassic Park Shares with coloured coins. I've mentioned these in previous blogs posts let me know if you want in. Still, the top name on the list was a bit of a mystery.

Further to this the value of these tokens, of which the best biggest at least is virtually junk, is not included in the Etherium price. This means that Etherium and note there are also some tokens from Omni, Nxt and NEO on the list, have got $7.6 billion dollars worth of tokens relying on their network. Those token don't only rely on their master network for security but should their value collapse, the master network also has a lot of funds locked up in these ICO, should they come under financial pressure, these funds can be dumped into the market, dropping the value of the master networks currency.

I don't think Etherium will die, but I think the ICO bubble will lose its shine. Bitcoin ICO's are now more attractive given the falling transaction costs with segwit, sidechains, lightning and friendly forks. This combined with delayed hard fork upgrades for Etherium mean is not looking to flash at the moment.

Friday 6 October 2017

Wednesday 4 October 2017

Saturday 16 September 2017

Bisq - Decentralised Bitcoin Exchange

We have a decentralised exchange. now we just need more people to use it. Bisq is pretty awesome, the programme works well, looks nice and is free to download on your computer. It's even developed in a decentralised way.

Crypto Girls that Rock

Cryptopunks aren't like that. I've been wanting to post props for these girls for a while.

So here are some internet links to some people I think are doing good work,

Julia Toaranski, video blogger, and anarchist

Meltem Demirors, Digital currency guru

Amanda B. Johnson the Dash "Daily Decrypt" girl

and

Marguerite deCourcelle the for pink coin. They are running a crypto fundraiser for Hurricane Irma and a whole lot of other things Its actually and complete charity platform. Better get on and donate.

Even though most of us are nerds behind computers there are some of us who are cool. Please post any I've missed below.

Segwit is in but 2x is not.

I started writing this piece before the Bcash fork and at the time I was positive about the Segwit2x compromise. Segiwit2x seemed a far better option than the BCash unlimited crowd proposed.

2mb blocks would give added quick relief for transactions and increase its practicality whilst keeping bitcoin nodes at level easy enough for anyone to run on their home computer.

Some people were up in arms about any part of increasing blocks, but with so many things lately, I think this is a bipolar sound bite like reaction. People talk about the political nature of it, as some kind of corporate take over. I am very sympathetic to this debate when it comes to block size, but I'm not fully convinced.

The fact that the signaling was agreed to by a bunch of bitcoin companies and miners behind closed doors, I think is not ideal, but I still think this represents the decentralised process that Bitcoin is founded on. Decentralisation can happen in different ways and need not always be digital.

At the time users got what they wanted with Segwit and 2mb blocks in 90 days seemed reasonable. Micro-transactions are cool and nodes are not that hard to run. Mine run on my home computer and I can still stream games and tv. I get the feeling I could probably run a node on my old cell phone. On the flip side however, when I am doing serious work on my computer even with 1mb blocks, I do not run the node as it does slow things down.

The idea of this compromise and the events that unfolded, I think, are proof that the system works politically and I think its one of the best things to happen for bitcoin yet. We could get the best of both worlds, a solid Segwit soft fork and likely a secure 2mb hard fork 90days after. This gives the ideal result for Bitcoin and provides solutions that have stood up to debate and mass technical scrutiny. As a long time enthusiast it seems like natural consensus paradise and with the price then at over $2500usd things were looking good.

In the last few weeks that optimistic thinking has proved, in typical cryptoboom fashion, not to be optimistic enough. What seemed like chaotic behaviour has proved to be very wise. Transaction fees have dropped and blocks are now remaining healthily within the segwit only size limitations. It is proving that with segwit implemented, the larger blocks of 2x will indeed not be necessary. So even the order of implementation was correct. Bitcoin has become its old antifragile self, and the value has nearly doubled since.

Further to the success of segwit, the closed-door meeting agreement is beginning to show signs of weakening. The old world legal administrative structure, which blockchain does also in part propose to solve, has shown its flaws. The traditional written contract used for the 2x compromise, stated that there would be "single chain" for the 2x implementation and many people are saying that this make it void. We now have the bitcoin fork Bcash and we have no guarantee that the 90 day 2x deal will be able to prevent a new fork when it is made. We should have known that the language of contracts is not like the math involved in our decentralised bitcoin system.

Change proponents now know that they should hard code in their changes and that closed door deals are unlikely to work. It turns out the trustless system is the only one that can be trusted.

2mb blocks would give added quick relief for transactions and increase its practicality whilst keeping bitcoin nodes at level easy enough for anyone to run on their home computer.

Some people were up in arms about any part of increasing blocks, but with so many things lately, I think this is a bipolar sound bite like reaction. People talk about the political nature of it, as some kind of corporate take over. I am very sympathetic to this debate when it comes to block size, but I'm not fully convinced.

The fact that the signaling was agreed to by a bunch of bitcoin companies and miners behind closed doors, I think is not ideal, but I still think this represents the decentralised process that Bitcoin is founded on. Decentralisation can happen in different ways and need not always be digital.

At the time users got what they wanted with Segwit and 2mb blocks in 90 days seemed reasonable. Micro-transactions are cool and nodes are not that hard to run. Mine run on my home computer and I can still stream games and tv. I get the feeling I could probably run a node on my old cell phone. On the flip side however, when I am doing serious work on my computer even with 1mb blocks, I do not run the node as it does slow things down.

The idea of this compromise and the events that unfolded, I think, are proof that the system works politically and I think its one of the best things to happen for bitcoin yet. We could get the best of both worlds, a solid Segwit soft fork and likely a secure 2mb hard fork 90days after. This gives the ideal result for Bitcoin and provides solutions that have stood up to debate and mass technical scrutiny. As a long time enthusiast it seems like natural consensus paradise and with the price then at over $2500usd things were looking good.

In the last few weeks that optimistic thinking has proved, in typical cryptoboom fashion, not to be optimistic enough. What seemed like chaotic behaviour has proved to be very wise. Transaction fees have dropped and blocks are now remaining healthily within the segwit only size limitations. It is proving that with segwit implemented, the larger blocks of 2x will indeed not be necessary. So even the order of implementation was correct. Bitcoin has become its old antifragile self, and the value has nearly doubled since.

Further to the success of segwit, the closed-door meeting agreement is beginning to show signs of weakening. The old world legal administrative structure, which blockchain does also in part propose to solve, has shown its flaws. The traditional written contract used for the 2x compromise, stated that there would be "single chain" for the 2x implementation and many people are saying that this make it void. We now have the bitcoin fork Bcash and we have no guarantee that the 90 day 2x deal will be able to prevent a new fork when it is made. We should have known that the language of contracts is not like the math involved in our decentralised bitcoin system.

Change proponents now know that they should hard code in their changes and that closed door deals are unlikely to work. It turns out the trustless system is the only one that can be trusted.

Wednesday 6 September 2017

Nuclear Proof Money

Trace Mayer talks about how bitcoin is the only sound form of money that can not be confiscated by force. You can hold agun to someones head but if they dont give you the code, or tell you the co signatories whom hold the other parts of the multisignature then you can't get the funds. There are no profit driven third parties to comondeer, no way to intimidate pottentially anonymous holders and no way to incircle and confiscate something that doesn't have to exists anywhere but in mathematics.

The concept is a lot simpler when we consider the situation of a nuclear attack. you cant blow up bitcoin with an H bomb, but cash, banks, stocks and even property and gold can become radio active and useless. 'Hopefuly we never see this, but prepers would be wise to get there bitcoin stash and satelite phone ready.

The concept is a lot simpler when we consider the situation of a nuclear attack. you cant blow up bitcoin with an H bomb, but cash, banks, stocks and even property and gold can become radio active and useless. 'Hopefuly we never see this, but prepers would be wise to get there bitcoin stash and satelite phone ready.

Tuesday 29 August 2017

The Golden Fork

We have been dining out on a Bitcoin bull market. Crypto currencies are consolidating and the stock market is in decline. What was once a scary proposition, the hard fork, is now revealing itself as something else. The golden fork.

Anyone who had bitcoin a month ago now owns Bitcoin (worth $4200 at the time of writing) and Bitcoin Cash (worth $700) SO That's a gain. a win win, in fact, something to look forward to.

Now we have a potential third fork on the horizon with the second half of the Segwit2x agreement, the 2x part. I think that this will actually ramp the price of Bitcoin up.

Due to the relative success of Bitcoin Cash (also called BCash, BCC, BCH) the forking phenomenon could well also become a greater trend. Exacerbating the benefits from getting into Bitcoin early.

We will be creating a triple star formation. I previously illustrated a binary star analogy to describe the working of the blockchain into user and miners threads. The third star will be for Bitcoin industry companies. This dilutes the counter balance of and I think reduces the threat to the user blockchain

It is a bright future for Bitcoin. Etherium ICO frenzies are taking a step back. The new crypto bull market might be on the fork.

Anyone who had bitcoin a month ago now owns Bitcoin (worth $4200 at the time of writing) and Bitcoin Cash (worth $700) SO That's a gain. a win win, in fact, something to look forward to.

Now we have a potential third fork on the horizon with the second half of the Segwit2x agreement, the 2x part. I think that this will actually ramp the price of Bitcoin up.

Due to the relative success of Bitcoin Cash (also called BCash, BCC, BCH) the forking phenomenon could well also become a greater trend. Exacerbating the benefits from getting into Bitcoin early.

We will be creating a triple star formation. I previously illustrated a binary star analogy to describe the working of the blockchain into user and miners threads. The third star will be for Bitcoin industry companies. This dilutes the counter balance of and I think reduces the threat to the user blockchain

It is a bright future for Bitcoin. Etherium ICO frenzies are taking a step back. The new crypto bull market might be on the fork.

Saturday 19 August 2017

What If China Stops Renewing US Bonds and Buys Bitcoin?

China has over 1 trillion USD in United States government treasuries. Currently the most in the world. What if China decided it didn't want to hold them anymore.

As an exporting country this could be difficult as repatriating the USD to Yuan would put the price of the Yuan up which in turn would stifle exports, but what if instead of this it simply bought Bitcoin with the USD.

The price of Bitcoin in USD would go up. This would make it hard for US citizens to get buy bitcoin. China's Bitcoin stash could then be used for its general public in the international markets.

This would be a major conspiracy, but if it should happen, the Bitcoin price should be at least 16.4 times what it is today just based on market cap. That's a price of at least $69371 USD. This is the next moon What if any other countries should follow? there are significant inc incentives for countries to do this.

As an exporting country this could be difficult as repatriating the USD to Yuan would put the price of the Yuan up which in turn would stifle exports, but what if instead of this it simply bought Bitcoin with the USD.

The price of Bitcoin in USD would go up. This would make it hard for US citizens to get buy bitcoin. China's Bitcoin stash could then be used for its general public in the international markets.

This would be a major conspiracy, but if it should happen, the Bitcoin price should be at least 16.4 times what it is today just based on market cap. That's a price of at least $69371 USD. This is the next moon What if any other countries should follow? there are significant inc incentives for countries to do this.

Monday 14 August 2017

Bitcoin Proliferation is also great for American Macro Economics

There was a few months this year where, for the first time in recent history the bitcoin price in USD was leading the market. This has been rare, in the past the Chinese have seemed to be much faster to get exited about spikes in the bitcoin price,

IN February I was planning to write this post and had just finished a post about how good bitcoin is for Chinese macro. Time has flown by, but the story of how bitcoin can actually be good for the USA, as a government, has actually become more clear. Legislation and media are even getting behind it.

The idea behind why its good is pretty basic. Although this is Pluto like speculation, why not bullet point it;

Some people might logically think it could be the best thing you could do . The benefits could be;

The next blog on macro will be about when a smaller country might approach a tipping point.

IN February I was planning to write this post and had just finished a post about how good bitcoin is for Chinese macro. Time has flown by, but the story of how bitcoin can actually be good for the USA, as a government, has actually become more clear. Legislation and media are even getting behind it.

The idea behind why its good is pretty basic. Although this is Pluto like speculation, why not bullet point it;

- The USA has a lot of debt to foreign countries in USD.

- The strong USD doesn't really help the US industrial exports especially that lead to trade deficits.

- Other countries hold large reserves in USD which give them some leverage over the country (China's 3 Trillion odd USD in bonds, Switzerland's giant US stock stash)

- The average American also has plenty of personal debt.

- Money printing and inflation can be used and abused in the transition period

Some people might logically think it could be the best thing you could do . The benefits could be;

- No more national debt

- Good exports with minimal disruption, leading to more jobs

- No leverage from foreign powers

- Reduce the average Americans debt

- The whole thing happened because some anonymous internet money that is totally decentralised and we obviously couldn't have seen coming, "sorry creditors, it's not our fault"

- the government can get itself out of a difficult fiscal and macro economic position, without the hard sacrifices that might normally be needed.

- USA would be a first mover on what could become the new world reserve currency

The next blog on macro will be about when a smaller country might approach a tipping point.

Sunday 23 July 2017

Thursday 20 July 2017

The Crypto Binary Star

This drawing is inspired by Andrew DeSantis here's a drawing showing the Bitcoin network in a natural state of forking and merging. Bitcoin is like a binary star with many sidechains and networks orbiting it. With the user and the miner coded agendas in the centre and Ether as the mysterious unknown dark matter. Bitcoin will become like a world clock or a sun for time-based programming life.

Monday 10 July 2017

Segwit2x UASF Paradise

Possibly my worst most juvenile cartoon ever, but I am so excited about ending the block debate and getting consensus I couldn't care less, it's the natural consensus paradise. Transactions will be cheap again and the problem is solved in a sustainable way. Whatever happens in my opinion, it's looking like good good fun times. Segwit2x isn't so bad, even if proved not to be ideal it's better politics than we see elsewhere. UASF actually worked and Mark Karlples might actually make us richer.

Friday 26 May 2017

Altcoins are Making Kids Rich

There was a time not so long ago when if I had a young son, I may have paid them to do the yard work in Doge. 1 million Doge may not have been out of the question. Now that Doge is worth $3700 NZD. Time to join the cool kids crypto club is running out. It seems old money was a joke and Doge wins at being funny fun times! Altcoins are on a tear and 5 year old shibes around the world are getting ahead.

Even as dogerain closes down, mainly dues to the new cost of transactions, the generation of Dogeilionares are resistant and the memes keep flowing. In the new cryptoland even Doge may need segwit. Go the random resistance!

.

Even as dogerain closes down, mainly dues to the new cost of transactions, the generation of Dogeilionares are resistant and the memes keep flowing. In the new cryptoland even Doge may need segwit. Go the random resistance!

.

Wednesday 24 May 2017

The Price is UP Big Time but Where is the Volume?

The Price of bitcoin and a whole raft of crypto currencies are up a lot lately. It seems like everyone wants a slice of cryptographic pie, people are talking about it, but when we look at the charts it looks like less people are buying now than in 2013.

Bitstamp

OK Coin and Chinese volume seems to have completely dropped off months ago and haven't picked up. In part because of removal of bitcoin with drawals and leverage.

People say that a lot of new volume is on in Korea and . With their top exchanges bithumb and Bitflyer respectively. They stand rank currently at number 2 and three of exchanges world wide.

Overall we can see that the total USD volume has gone up some. 300million, that's a worldwide figure) but not nearly as much as you might expect. Coinhills is a good site to check exchange volumes.

Polinex as number 1 ranked exchange, seems to be dominating the market. It offers a large variety of Altcoins. Given that fiat volumes are not that high, could this altcoin trading be helping to fuel the boom. Altcoin prices are going up faster than bitcoin in many places but are very volatile. So people need to get in and out of altcoins and when they do that the go through bitcoin because it's like the USD of the cryptocurrency world.

My prediction made here and here again are coming true, but a lot more that I didn't expect could be taking shape.

Bitstamp

OK Coin and Chinese volume seems to have completely dropped off months ago and haven't picked up. In part because of removal of bitcoin with drawals and leverage.

People say that a lot of new volume is on in Korea and . With their top exchanges bithumb and Bitflyer respectively. They stand rank currently at number 2 and three of exchanges world wide.

Overall we can see that the total USD volume has gone up some. 300million, that's a worldwide figure) but not nearly as much as you might expect. Coinhills is a good site to check exchange volumes.

Polinex as number 1 ranked exchange, seems to be dominating the market. It offers a large variety of Altcoins. Given that fiat volumes are not that high, could this altcoin trading be helping to fuel the boom. Altcoin prices are going up faster than bitcoin in many places but are very volatile. So people need to get in and out of altcoins and when they do that the go through bitcoin because it's like the USD of the cryptocurrency world.

My prediction made here and here again are coming true, but a lot more that I didn't expect could be taking shape.

Friday 19 May 2017

Intellectual Centralisation

I'm starting to get the feeling that in the future wizards type characters of our fantasy novels may actually come to be. Sorcerers of code and finance, shamans which future minions will come to to fix tablets and robots, for life advise and for mystical financial support.

With the lightning network We are adding layer to bitcoin, something that most people already struggled to understand. I didn't make it through the lightning networks white paper, The bitcoin white paper in comparison could be read to a four year old as a bed time story. For me the lightning network might have to remain in the magical category. That is like the mysterious inner workings current global financial system or how the hell i swipe the eftpos card and then the shop owners lets me take stuff. Where before bitcoin was fully explainable I think the lighting network will remain in the to hard basket "Don't worry it just works".

We don't want bitcoin and crypto currency as a whole to be come to become to complex, because in a way that would make it like the financial system it is built to replace. The progression of programing and the growth of the market is a natural force of intellectual centralisation. Though necessary, the mechanics of this kind of programing are beyond the general public. We need to actively resist complexity and the lack of education or it intellectual centralisation will inevitably happen.

Some bitcoiners love to show off their knowledge when discussing and explaining bitcoin, but this excludes some people from really participating. This defeats the dencetralised ideals on which bitcoin is supposed to be founded. Many new buyers of bitcoin are completely unaware of how it really works. Others feel that its not worth trying to understand. The concept of transaction fees rising, in itself can be confusing. That's not to mention quantum physics, string theory, micro processors, AI, interstellar travel and the big ban that us nerd talk about at bitcoin meetups. We don't want people to feel excluded from a global revolution because they think that they are not smart enough.

Old bitcoiners dream about the Higgs Boson and Astronomy whilst they HODL their millions, but many new enthusiasts don't have a clue. I'm not sure we want to impose nerd culture on the general public we need to ease them into a full enlightenment.And without coming across cultish, its a fine line. I'm a fan of keeping bitcoin as simple as possible and not blowing nubies minds when we explain to them "how bitcoin works", the price lately is enough to do that.

With the lightning network We are adding layer to bitcoin, something that most people already struggled to understand. I didn't make it through the lightning networks white paper, The bitcoin white paper in comparison could be read to a four year old as a bed time story. For me the lightning network might have to remain in the magical category. That is like the mysterious inner workings current global financial system or how the hell i swipe the eftpos card and then the shop owners lets me take stuff. Where before bitcoin was fully explainable I think the lighting network will remain in the to hard basket "Don't worry it just works".

We don't want bitcoin and crypto currency as a whole to be come to become to complex, because in a way that would make it like the financial system it is built to replace. The progression of programing and the growth of the market is a natural force of intellectual centralisation. Though necessary, the mechanics of this kind of programing are beyond the general public. We need to actively resist complexity and the lack of education or it intellectual centralisation will inevitably happen.

Some bitcoiners love to show off their knowledge when discussing and explaining bitcoin, but this excludes some people from really participating. This defeats the dencetralised ideals on which bitcoin is supposed to be founded. Many new buyers of bitcoin are completely unaware of how it really works. Others feel that its not worth trying to understand. The concept of transaction fees rising, in itself can be confusing. That's not to mention quantum physics, string theory, micro processors, AI, interstellar travel and the big ban that us nerd talk about at bitcoin meetups. We don't want people to feel excluded from a global revolution because they think that they are not smart enough.

Old bitcoiners dream about the Higgs Boson and Astronomy whilst they HODL their millions, but many new enthusiasts don't have a clue. I'm not sure we want to impose nerd culture on the general public we need to ease them into a full enlightenment.And without coming across cultish, its a fine line. I'm a fan of keeping bitcoin as simple as possible and not blowing nubies minds when we explain to them "how bitcoin works", the price lately is enough to do that.

Thursday 18 May 2017

The Power of the Node

The decentralised power of the bitcoin node has proved itself over the last 6 months. But as many of us have turned off our full nodes the reality is that power struggle between miners and users and centralisation continues. It may never end. But then there is UASF. I also find "Emergent Consensus" by the BU guys a little bit scary. The key to this is to get involved.

Bitseed, however are offering a nice quite solution.you just plug it in to your modem, now you have a seed, enough to save the network through an EMP mega storm. I feel safe knowing these are being sent all over the world.

https://bitseed.org/product/core/

10 watts!

Bitseed, however are offering a nice quite solution.you just plug it in to your modem, now you have a seed, enough to save the network through an EMP mega storm. I feel safe knowing these are being sent all over the world.

https://bitseed.org/product/core/

10 watts!

Sunday 7 May 2017

One Moon Rocket or Multiple Coin Space Exploration?

Some feel now that bitcoin is already at the moon. Alternative crypto currencies have been gaining on this feeling. The metaphor might need to be drawn out into general space exploration. There is a lot happening at once. Where altcoins where once obscure they are now becoming well known. Overall maker cap of crypto currencies is over $40 billion USD.

Litecoin is at $29

Etherium is at $93

Dash is at $102

Monero is at $30

Zcash is at $104

Doge is at a tenth of a cent $0.001! That makes all us Dogeillionares, USD thousandares! Pretty good for a fun time coin.

We might have to get used to the idea of many space explorations. 10x is happening for some of the 100's of altcoins on the charts, 20% plus gains is common. Bitcoin is now testing $1600 USD. I get a feeling that someday we will be talking about a bitcoin mars landing.

Litecoin is at $29

Etherium is at $93

Dash is at $102

Monero is at $30

Zcash is at $104

Doge is at a tenth of a cent $0.001! That makes all us Dogeillionares, USD thousandares! Pretty good for a fun time coin.

We might have to get used to the idea of many space explorations. 10x is happening for some of the 100's of altcoins on the charts, 20% plus gains is common. Bitcoin is now testing $1600 USD. I get a feeling that someday we will be talking about a bitcoin mars landing.

Bitcoin Hovers Over $1500 USD

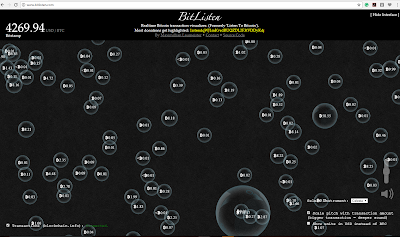

The total market cap has grown to over $26 billion USD with the price making rapid and consistent gains. The question is whether the existing infrastructure justifies this? This graphic represents bitcoins digital city.

Altcoins have also been on the rise now making up a larger percentage of the total cryptocurrency market. It could be due to bitcoin congestion. In a way, alternative crypto currencies are like satellite cities.

Tuesday 11 April 2017

Sunday 9 April 2017

Do High Transaction Fees Give More Meaningful Transactions?

The block size debate is reaching a new higher level, we may never get over it. With the slow propagation of segregated witness and the heavy transaction load on the bitcoin network seen in the last months as the price retests $1200USD. The once simple debate, it has now become philosophical and expansive. It can be polarising, we now have bitcoin Unlimited being proposed rather than just 2mb blocks, but broad concepts need to be taken into account. It calls for a fresh morning mind I had. I had felt a little hazy on the subject until this morning. I think the debate is a challenge worth detailed discussion.

The heart of the debate is what you believe is the main purpose of the bitcoin blockchain. To me after allowing for transaction to occur in a decentralised way, providing transparent transaction information is its main purpose. This I think is an antidote to the problems of the 2008 financial crisis.

Transparency and publicly useful information sets bitcoin apart from the more anonymous altcoins (like Dash or Monero, some people would gladly drop public information for privacy). The bitcoin blockchain allows the public to track and analyse the flow of value in the world in real time in a way that was impossible in the past.

The problem now is that if someone wants to buy ice cream from the store and have the transaction be on the blockshain in ten minutes then they would need to pay a fee equivalent to 50c. Not really practical and not good for adoption, especially in the poorest countries that need bitcoin the most.

Segregated Witness, a technical bitcoin upgrade, is set to help with this by more than doubling the capacity of the bitcoin network and therefore reducing the amount competition in the elective fee market. But as "SegWit" comes in it also allows for sidechains and the lightning network. this is no small change, they effectively allow for infinite transactions. Though the block size easily becomes the focus, It is actually the auxiliary applications that are most significant and that may come at a higher cost. there are risks here to decentralisation, transparency and quality of information.

Sidechains can be centralised (owned by a company) which is very un bitcoin like. Though they might be seen as a poor substitute they do offer a good medium ground for people transitioning from banks. They are likely to have a real time record of transactions that is easily compatible with current block chain analysis software. Corporate governance lays a veil in front of transparency and allow government involvement. Side chains are also not required to publish their transactions. This means information on some ice cream transactions can be lost. Sidechains mirror the altcoin function and in my opinion erodes bitcoins point of difference.

The lightning network is in a way similar to sidechains in that it makes transactions off chain near unlimited, but it is different because it is not centralised. It does however potentially impact on transparency by adding a layer of complexity to the information that can be extracted from the blockchain. This is because transactions use smart contracts secured by the blockchain and are not accounted for in the standard transaction format. Lightning network, i think on the whole is a better system, as far as sticking to the original principles of bitcoin as digital cash, but it could compromise bitcoins point of difference as a transparent record as compared with more private crypto currencies.

Does bitcoin need all of its transactions to show up on the block chain? Many would argue that this currently doesn't happen anyway. Do we need a permanent publicly traceable record of transactions less than $5 in value? I argue that we can split transactions into multiple types and get better information, better privacy and better transparency all at once.

Already user are able to divide and manipulate transactions into larger and smaller parts on the blockchain. They may want to do this to hide the true purpose of the transaction ie: illegal stuff. At the moment this is expensive. These transactions will move to specific sidechains and networks because of the costs and this somewhat false coin mixing data will no longer muddle blockchain data. Transaction requiring low levels of trust will also move off of the blockchain, for example when people need to move funds from one personal wallet to another. the cup of coffee purchases will also begin to make more sense on the blockchain because they can all just be aggregated when merchants sell bitcoin. At present it is possible that merchant payments show up twice on the blockchain, as the item is purchased and again as the coins are sold. The better data differentiation and aggregation within bitcoin may actually give us a clearer view of what is going on in the bitcoin economy.

Big data is a complex issue. It may be that the NSA's "collect it all and get no distortion" philosophy is not ideal when looking specifically at financial data. A compromise may be needed to preserve decentralisation, transparency and maintain useful information on the blockchain. In a world where bitcoins transactions are ever increasing and altcoins are fast on its tail, something needs to be done. Bitcoin will become more complex but I think analytical systems will be able to handle it.

The heart of the debate is what you believe is the main purpose of the bitcoin blockchain. To me after allowing for transaction to occur in a decentralised way, providing transparent transaction information is its main purpose. This I think is an antidote to the problems of the 2008 financial crisis.

Transparency and publicly useful information sets bitcoin apart from the more anonymous altcoins (like Dash or Monero, some people would gladly drop public information for privacy). The bitcoin blockchain allows the public to track and analyse the flow of value in the world in real time in a way that was impossible in the past.

The problem now is that if someone wants to buy ice cream from the store and have the transaction be on the blockshain in ten minutes then they would need to pay a fee equivalent to 50c. Not really practical and not good for adoption, especially in the poorest countries that need bitcoin the most.

Segregated Witness, a technical bitcoin upgrade, is set to help with this by more than doubling the capacity of the bitcoin network and therefore reducing the amount competition in the elective fee market. But as "SegWit" comes in it also allows for sidechains and the lightning network. this is no small change, they effectively allow for infinite transactions. Though the block size easily becomes the focus, It is actually the auxiliary applications that are most significant and that may come at a higher cost. there are risks here to decentralisation, transparency and quality of information.

Sidechains can be centralised (owned by a company) which is very un bitcoin like. Though they might be seen as a poor substitute they do offer a good medium ground for people transitioning from banks. They are likely to have a real time record of transactions that is easily compatible with current block chain analysis software. Corporate governance lays a veil in front of transparency and allow government involvement. Side chains are also not required to publish their transactions. This means information on some ice cream transactions can be lost. Sidechains mirror the altcoin function and in my opinion erodes bitcoins point of difference.

The lightning network is in a way similar to sidechains in that it makes transactions off chain near unlimited, but it is different because it is not centralised. It does however potentially impact on transparency by adding a layer of complexity to the information that can be extracted from the blockchain. This is because transactions use smart contracts secured by the blockchain and are not accounted for in the standard transaction format. Lightning network, i think on the whole is a better system, as far as sticking to the original principles of bitcoin as digital cash, but it could compromise bitcoins point of difference as a transparent record as compared with more private crypto currencies.

Does bitcoin need all of its transactions to show up on the block chain? Many would argue that this currently doesn't happen anyway. Do we need a permanent publicly traceable record of transactions less than $5 in value? I argue that we can split transactions into multiple types and get better information, better privacy and better transparency all at once.

Already user are able to divide and manipulate transactions into larger and smaller parts on the blockchain. They may want to do this to hide the true purpose of the transaction ie: illegal stuff. At the moment this is expensive. These transactions will move to specific sidechains and networks because of the costs and this somewhat false coin mixing data will no longer muddle blockchain data. Transaction requiring low levels of trust will also move off of the blockchain, for example when people need to move funds from one personal wallet to another. the cup of coffee purchases will also begin to make more sense on the blockchain because they can all just be aggregated when merchants sell bitcoin. At present it is possible that merchant payments show up twice on the blockchain, as the item is purchased and again as the coins are sold. The better data differentiation and aggregation within bitcoin may actually give us a clearer view of what is going on in the bitcoin economy.

Big data is a complex issue. It may be that the NSA's "collect it all and get no distortion" philosophy is not ideal when looking specifically at financial data. A compromise may be needed to preserve decentralisation, transparency and maintain useful information on the blockchain. In a world where bitcoins transactions are ever increasing and altcoins are fast on its tail, something needs to be done. Bitcoin will become more complex but I think analytical systems will be able to handle it.

Saturday 8 April 2017

Bitcoin Inflation Convergence

A few months ago bitcoins "inflation" rate was effectively halved from 8% to 4%. This happens through a process called the halving, where the supply of new bitcoins is reduced every 210,000 blocks (or approximately every four years). We have seen demand for the currency growing faster than this creation rate which theoretically leads to bitcoins price increase. Since the last halving we have seen the price of bitcoin go up around 80% to date.

National price inflation rates, the ones people used to talk about in the 80's and 90's are rising reported at around 2% in the USA. What happens when bitcoins reducing inflation rate and increasing headline inflation rates converge? Could there be a relationship between interest rates, national inflation and bitcoins increasing value. Could this changing environment put cash "behind the curve" in a whole new way?

Though these are not calculated in quite the same way for bitcoin, at its next halving it's inflation rate (1.73%) will match the 2% target or ceiling that many countries now use. At this point, we could assume that the bitcoin price should be theoretically stable against the dollar if all other factors stayed the same and volatility is put aside. This halving is due to happen in 2020 with another in 2024 and again until eventually, the rate becomes zero. At this point, we could expect the bitcoin price go up, all things equal again, by the same rate as the national inflation of that year. If countries hold a 2% inflation rate this means the older bitcoin gets the more upward pressure there is on its price and the more attractive it is a store of value as compared with cash. In other words, bitcoin users automatically earn interest on all their bitcoin accounts.

You can see in this situation why more and more people would prefer to be involved in the bitcoin economy and want to move all their finances into this space. The math that once had the effect on average of slightly dampening bitcoins price growth will start to provide an increasing boost. There comes a point where if you are a large investor and have cash you will want to move it all over to bitcoin. Further to this, the curve can become moon like when it gets to a point where it will be worthwhile for a company, able to take out a fiat loan at a low rate, to hold bitcoin with that money rather than pay down debt. Because you can deduct the inflation rate from the interest and then add the expected gains from holding the asset,

A key to the situation is the level of integration in the economy and digitisation. Where the cost of goods in bitcoin can be updated in real time, the cost of goods in your store with stickers on them are not changed as easily. The inflation convergence concept is strengthened when bitcoin prices for goods become more sticky. Without this bitcoin doesn't counter inflation as directly. online goods purchased with bitcoin simply have prices to mirror those of goods in fiat on a day to day basis. The fiat inflation is masked in the volatility of the bitcoin price. Often high bitcoin prices lead to higher levels of bitcoin spending and stores often sell their bitcoin straight away leading the bitcoin price to fall. Many of the technical advantages of the international cryptocurrency are lost. If bitcoin is not economically integrated price movement simply interpreted as "a bubble" and that inhibits real uptake and removes any sticky prices altogether.

Everything of course is comparative. In Venezuela, for example, quoting a bitcoin price is better than using your own currency, where in the USA digitally converting to USD prices is favoured. The inflation rate is also much higher there, so run away inflation could be a major to bitcoin utility and price increase. Which comes first is hard to tell. With bitcoins current adoption level, new tools could be developed to measure bitcoin inflation in the same way countries do. This would help. With fiat inflation increasing some people may start wanting to use bitcoin as a checking account and not just as savings. It is a slow process in different pockets of the world but it is proving to be sustained. It could be exponential.

Mathematically bitcoin is transitioning into deflationary bitcoin environment, and that means the value of bitcoin should continue to go up should it prove to be a truly hard currency. The only way for Janet Yellen to get behind the bitcoin curve is to put interest rates up fast and try to induce some fiat deflation... And that I think is unlikely.

Tuesday 21 March 2017

The Follow Follow Arbitrage Positive Bias

Recently in the bitcoin market a switch has occurred. The PBoC have suspended bitcoin withdrawals from Chinese bitcoin exchanges and the Chinese bitcoin markets, normally leading the way, have dropped and become timid. Now instead of the European western market following the Chinese markets, it is the other way around, the USD exchange rates are leading the market. There are some psychological factors at play. I call these the follow trade and the follow follow trade.

The follow trade effect happens when traders see the more volatile market as an indicator of what's likely to happen in their home market. They buy their home market in the assumption that the price of a bitcoin should be similar across the world. The follow follow trade is where this confirmation of a trend started at home in now in both markets leads to more buying in the original market.

Rates in different countries also tend to be drawn together in the longer term by a process called arbitrage. This is where people can sell bitcoins on one exchange with a high price, do a swift transfer to an exchange in a country with cheaper bitcoins. Alternatively traders can buy bitcoins on a cheap exchange send them via the bitcoin network to an exchange with a high rate and sell them there. These two alternate processes can be repeated until the market prices come together. the Chinese and US markets have been around $50 or 5% for the last month so you could have done this cycle six or seven times over. The profit is limited only by the speed and cost of a SWIFT transaction, about three to five days.

Five days is a long time in the digital currency world where a lot can happen quickly. It quickly becomes apparent that the arbitrage trade works best in one direction. Arbitrage is best when transferring bitcoins to the highest exchange and selling there. Bitcoin transfers can happen internationally within 10 minutes and cost much less that other transfer methods. Arbitrage opportunities pop up the whilst the overall price can be moving up or down and they are seen more commonly during volatility. The swift side of the arbitrage trade is ok, useable when the bitcoin market is going down or flat, but not good when it is rising. The time delay gives a risk of the arbitrage disappearing whilst the money is stuck in SWIFT limbo land and the arbitrage trader also misses out on the overall up movement of the market.

The only way to sustain the bitcoin transfer side of the arbitrage trade without a swift transfer is to keep on buying on the exchange with the cheap rates. This exchange would likely need to be in your home country otherwise it would take a long time for your money to get there. It is a lot easier to find a good arbitrage trade if you have a lot of fiat funds on the exchanges in different countries ready to buy bitcoin with.

Therefore in order to take advantage of arbitrage more and more fiat capital is required to be available to the market and this creates a positive bias. The more volatility the more arbitrage the more capital available, the more the price stabilises. After the arbitrage is gone the traders have little choice but to invest more fiat to stay in the game. This increase in capital eventually increases the price.

In China when bitcoins can't be withdrawn because of the government suspension, this only serves to exaggerate this effect. They can't dampen the USD market with BTC transfers and profit from the arbitrage. They will not want to actually withdraw fiat as this could be used to buy cheap bitcoins. To much FOMO in an upward trending market. When your market is the lowest the capital simply builds up and flows in. the USD value is not dampened by as much arbitrage and the Chinese become captivated by the follow trade. The USD market is charged by the follow follow trade. As long as the USD rate is above the Chinese rate it is a moon sand wedge.

The follow trade effect happens when traders see the more volatile market as an indicator of what's likely to happen in their home market. They buy their home market in the assumption that the price of a bitcoin should be similar across the world. The follow follow trade is where this confirmation of a trend started at home in now in both markets leads to more buying in the original market.

Rates in different countries also tend to be drawn together in the longer term by a process called arbitrage. This is where people can sell bitcoins on one exchange with a high price, do a swift transfer to an exchange in a country with cheaper bitcoins. Alternatively traders can buy bitcoins on a cheap exchange send them via the bitcoin network to an exchange with a high rate and sell them there. These two alternate processes can be repeated until the market prices come together. the Chinese and US markets have been around $50 or 5% for the last month so you could have done this cycle six or seven times over. The profit is limited only by the speed and cost of a SWIFT transaction, about three to five days.

Five days is a long time in the digital currency world where a lot can happen quickly. It quickly becomes apparent that the arbitrage trade works best in one direction. Arbitrage is best when transferring bitcoins to the highest exchange and selling there. Bitcoin transfers can happen internationally within 10 minutes and cost much less that other transfer methods. Arbitrage opportunities pop up the whilst the overall price can be moving up or down and they are seen more commonly during volatility. The swift side of the arbitrage trade is ok, useable when the bitcoin market is going down or flat, but not good when it is rising. The time delay gives a risk of the arbitrage disappearing whilst the money is stuck in SWIFT limbo land and the arbitrage trader also misses out on the overall up movement of the market.

The only way to sustain the bitcoin transfer side of the arbitrage trade without a swift transfer is to keep on buying on the exchange with the cheap rates. This exchange would likely need to be in your home country otherwise it would take a long time for your money to get there. It is a lot easier to find a good arbitrage trade if you have a lot of fiat funds on the exchanges in different countries ready to buy bitcoin with.

Therefore in order to take advantage of arbitrage more and more fiat capital is required to be available to the market and this creates a positive bias. The more volatility the more arbitrage the more capital available, the more the price stabilises. After the arbitrage is gone the traders have little choice but to invest more fiat to stay in the game. This increase in capital eventually increases the price.

In China when bitcoins can't be withdrawn because of the government suspension, this only serves to exaggerate this effect. They can't dampen the USD market with BTC transfers and profit from the arbitrage. They will not want to actually withdraw fiat as this could be used to buy cheap bitcoins. To much FOMO in an upward trending market. When your market is the lowest the capital simply builds up and flows in. the USD value is not dampened by as much arbitrage and the Chinese become captivated by the follow trade. The USD market is charged by the follow follow trade. As long as the USD rate is above the Chinese rate it is a moon sand wedge.

Friday 10 March 2017

No SEC, No Corporate Takover

Today the SEC in the USA declined to make an exception to an obscure rule for the Winklevoss twins bitcoin ETF application. It got declined. the bitcoin market, which in a sense had hoped for its acceptance, has taken a hit. Down to $975 at one point but now rising at over $1100 USD. There are at least two other ETF applications in play in the USA at the moment, but this one, in particular, has grabbed a sensitive reaction. Some would say bitcoins fabled volatility is back.

The ETF concept has a strange relationship with bitcoin. It is debatable wether the ETF actually makes investing in bitcoin more accessible to the general public.For young people comfortable with computers it is easier to buy the real thing than the ETF. So in a way listing on the New York stock exchange with ETF has been out-moded by bitcoins new international trading ecosystem. It does however make the investment more accessible to established investors who don't want to change the way they do things. Ironically the same establishment that got bailed out in 2009 and for the failing of which bitcoin is the intended cure.

In integrating with old money using the old financial establishment's tools there is a moral hazard for bitcoin. As the currency is in its infancy there is a risk that it could be overwhelmed by new larger financial stakeholder. At this point, the initial vision of the cryptocurrency may be distorted. We are seeing lots of volatility induced by government and large corporate organisations, evident in the release today. Do we actually want more of this?

A large popular ETF will add a new mysterious metric to the bitcoin structure and things like the blockchain debate. I'm not sure I like the SEC conferences being involved in our future. Where we now can talk freely about the pros and cons of on and off chain transactions, Bitcoin core and Bitcoin Unlimted, settling the score in the in the public forums of the internet. Backed up by the real-time node and hash rate statistics it's like a new hyper-democracy. We can see already that with the ETF comes closed door meetings, announcements by insiders and section b part 11 exert 6, paperwork burial.

Where we now come to the bitcoin prices in a fairly decentralised way, ETF's will likely lead to larger the stakes with more influence. This is more important when forking the code on the card. The corporate agenda and profit maximisation will edge its way into consideration. For example, if a bitcoin ETF holds a quarter of the total market cap of bitcoin ($5 billion worth) then bitcoin forks in two, say bitcoin and bitcoin unlimited, it will double its money. It will then also have the power to cash out of one side if it chooses at a time to its advantage in order to crash the price of that fork and gain an advantage over competing ETFs. This profitable scheme leads to fork pumping and dumping on a major scale due to the inherent vulnerability of new bitcoin forks.

Though ETF funds can't directly effect miners or node counts they do increase the centralisation of price discovery between forks. This could prevent a hard fork from ever being effective or ensure only forks that benefit the ETF find traction. This allows old smoke screen corporate politics into bitcoins publically programmed political structure.

Money talks, at least it used to. The bitcoin price would rise but it's still not clear if a corporate takeover is a good thing. I prefer echo chambers of the blogosphere and the Git hub hive mind.

The ETF concept has a strange relationship with bitcoin. It is debatable wether the ETF actually makes investing in bitcoin more accessible to the general public.For young people comfortable with computers it is easier to buy the real thing than the ETF. So in a way listing on the New York stock exchange with ETF has been out-moded by bitcoins new international trading ecosystem. It does however make the investment more accessible to established investors who don't want to change the way they do things. Ironically the same establishment that got bailed out in 2009 and for the failing of which bitcoin is the intended cure.

In integrating with old money using the old financial establishment's tools there is a moral hazard for bitcoin. As the currency is in its infancy there is a risk that it could be overwhelmed by new larger financial stakeholder. At this point, the initial vision of the cryptocurrency may be distorted. We are seeing lots of volatility induced by government and large corporate organisations, evident in the release today. Do we actually want more of this?

A large popular ETF will add a new mysterious metric to the bitcoin structure and things like the blockchain debate. I'm not sure I like the SEC conferences being involved in our future. Where we now can talk freely about the pros and cons of on and off chain transactions, Bitcoin core and Bitcoin Unlimted, settling the score in the in the public forums of the internet. Backed up by the real-time node and hash rate statistics it's like a new hyper-democracy. We can see already that with the ETF comes closed door meetings, announcements by insiders and section b part 11 exert 6, paperwork burial.

Where we now come to the bitcoin prices in a fairly decentralised way, ETF's will likely lead to larger the stakes with more influence. This is more important when forking the code on the card. The corporate agenda and profit maximisation will edge its way into consideration. For example, if a bitcoin ETF holds a quarter of the total market cap of bitcoin ($5 billion worth) then bitcoin forks in two, say bitcoin and bitcoin unlimited, it will double its money. It will then also have the power to cash out of one side if it chooses at a time to its advantage in order to crash the price of that fork and gain an advantage over competing ETFs. This profitable scheme leads to fork pumping and dumping on a major scale due to the inherent vulnerability of new bitcoin forks.

Though ETF funds can't directly effect miners or node counts they do increase the centralisation of price discovery between forks. This could prevent a hard fork from ever being effective or ensure only forks that benefit the ETF find traction. This allows old smoke screen corporate politics into bitcoins publically programmed political structure.

Money talks, at least it used to. The bitcoin price would rise but it's still not clear if a corporate takeover is a good thing. I prefer echo chambers of the blogosphere and the Git hub hive mind.

Sunday 12 February 2017

Saturday 11 February 2017

Bitcoin Proliferation is Good for Chinese Macro

The Bloomburg propaganda machine has been working overtime lately. They promote articles claiming that China is pulling the market down. The language is clear when they publish articles with plunge, crash, and free fall, despite the fact that bitcoin has been steadily rising over the last year and remains near all-time highs. They Promote fud so frequently that it is having a diminishing effect that people are charting.

It doesn't take long to see why they are untrustworthy, they have major support from organisations whom have a vested interest against Bitcoin, but let's also take a step back and look at the macro reasons. Why is it many American media outlets keep talking down bitcoin and why the Chinese aren't as threatened by bitcoin as one might think.

The Chinese are the major source or bitcoin repression according to American media. however China have been consistently trading bitcoin at higher prices than elsewhere in the world for at least the last two years. The capital flight drum gets beat here as a reason. Lets talk about the chinese macro economic environment.As you know are an exporting economy.They do a lot of their business with international transactions. These are often made in dollars, are slow and costly. They also have more people than any other country, you can see why they don't want to use someone else's a dollar. you can also see why a world currency would able to be transferred easily across borders for trade appeal to them.

In the past China has taken advantage of a weak currency which has given it a competitive advantage on its exports. this has helped build up their economy quickly. Now they are going to float their currency. This is in part because the IMF and WTO wanted them to do this to become part of the world currency call the SDR. (yes those are the world bankers acronyms, equivalent to advance crypto jargon, IMHO they are worse) China need to prove a stable currency for the IMF so they have held their currency level with a basket of currencies for many years. They have done this successfully but it just so happens that the USD has been going up out of line with their main trading partners and other countries in the SDR. Despite what many people think the Yuan is not in "free fall".

China have the largest foreign exchange reserves of any country. They own more USD than anyone else and more of other countries money as well. This is generally made up of government bonds built up over the last twenty years of trade surpluses and currency devaluation. So now that they want a stable currency, they can use this reserve to do it. Selling off foreign currencies for Yuan when they get to high against the Yuan or when the yuan needs support. China is holding a lot of USD, more than any other foreign currency so they made money out of the USD gain. They can also potentially influence a drop in the dollar. Scary I know, but 3 trillion in reserves, makes a pretty significant impact on a $15T a year FX market.

So what is the threat of bitcoin to China. It is such a small thing at the moment with around $15billion total market cap. What could be the potential risks of a prolific bitcoin to the governments agenda there?

The Chinese government already struggles to control its financial system. They try to impose strict rules on reporting and deposit rates, have recently removed dozens of corrupt officials and yet they still have real estate bubbles and stock market crashes. With the traditional system central administration is actually quite difficult. I would suggest that blockchain like technologies might actually provide a solution for central planners as the allow more transparency of transactions and better potential oversight. Bitcoin is not excluded from this.

Bitcoin is also practicle for exporting. It is not linked to any nation, making it neutral and great for bi-lateral agreements. China being first to adopt it would give it an advantage over its competitors and provide a moral high ground. The many emerging countries which China is actively trading with as part of its strategy can easily get on board. Countries with unstable politics, often with anti-American factions, will have no issue, and countries with no infrastructure but people with smart phones can leapfrog to the latest methods.

Further, with all of its foreign funds, the Chinese could gain a lot of control over bitcoin. With the potential of no longer needing their foreign funds to stabilise the Yuan. 1. they could make bitcoin stable 2. the could make the USD less stable. 3. they could push up the bitcoin price in foreign currencies without anyone really knowing,

All of this type of thing requires a market capitalisation in bitcoin, and transaction volumes, many factors higher than we currently have , but given this is sorted, it is al quite logical. Infact what happens in a financial crisis where the USD starts to drop before the Chinese have got their money out? The USD could restrict capital flight in some ways and in that case they may be left with no other method to repatriate their funds.

The speculation is fun, and I don't see a reason why the government of China would want to go down a path of repressing the bitcoin technology. I think the anti-communist libertarian idea of bitcoin is not the full picture. Bitcoin and certainly blockchain like technologies are more suited to communist type thinking than the current financial system. Chinese people are very quick to integrate new technologies into thier lives and I think we should give them some respect.

It doesn't take long to see why they are untrustworthy, they have major support from organisations whom have a vested interest against Bitcoin, but let's also take a step back and look at the macro reasons. Why is it many American media outlets keep talking down bitcoin and why the Chinese aren't as threatened by bitcoin as one might think.

The Chinese are the major source or bitcoin repression according to American media. however China have been consistently trading bitcoin at higher prices than elsewhere in the world for at least the last two years. The capital flight drum gets beat here as a reason. Lets talk about the chinese macro economic environment.As you know are an exporting economy.They do a lot of their business with international transactions. These are often made in dollars, are slow and costly. They also have more people than any other country, you can see why they don't want to use someone else's a dollar. you can also see why a world currency would able to be transferred easily across borders for trade appeal to them.

In the past China has taken advantage of a weak currency which has given it a competitive advantage on its exports. this has helped build up their economy quickly. Now they are going to float their currency. This is in part because the IMF and WTO wanted them to do this to become part of the world currency call the SDR. (yes those are the world bankers acronyms, equivalent to advance crypto jargon, IMHO they are worse) China need to prove a stable currency for the IMF so they have held their currency level with a basket of currencies for many years. They have done this successfully but it just so happens that the USD has been going up out of line with their main trading partners and other countries in the SDR. Despite what many people think the Yuan is not in "free fall".

China have the largest foreign exchange reserves of any country. They own more USD than anyone else and more of other countries money as well. This is generally made up of government bonds built up over the last twenty years of trade surpluses and currency devaluation. So now that they want a stable currency, they can use this reserve to do it. Selling off foreign currencies for Yuan when they get to high against the Yuan or when the yuan needs support. China is holding a lot of USD, more than any other foreign currency so they made money out of the USD gain. They can also potentially influence a drop in the dollar. Scary I know, but 3 trillion in reserves, makes a pretty significant impact on a $15T a year FX market.

So what is the threat of bitcoin to China. It is such a small thing at the moment with around $15billion total market cap. What could be the potential risks of a prolific bitcoin to the governments agenda there?

The Chinese government already struggles to control its financial system. They try to impose strict rules on reporting and deposit rates, have recently removed dozens of corrupt officials and yet they still have real estate bubbles and stock market crashes. With the traditional system central administration is actually quite difficult. I would suggest that blockchain like technologies might actually provide a solution for central planners as the allow more transparency of transactions and better potential oversight. Bitcoin is not excluded from this.

Bitcoin is also practicle for exporting. It is not linked to any nation, making it neutral and great for bi-lateral agreements. China being first to adopt it would give it an advantage over its competitors and provide a moral high ground. The many emerging countries which China is actively trading with as part of its strategy can easily get on board. Countries with unstable politics, often with anti-American factions, will have no issue, and countries with no infrastructure but people with smart phones can leapfrog to the latest methods.

Further, with all of its foreign funds, the Chinese could gain a lot of control over bitcoin. With the potential of no longer needing their foreign funds to stabilise the Yuan. 1. they could make bitcoin stable 2. the could make the USD less stable. 3. they could push up the bitcoin price in foreign currencies without anyone really knowing,

All of this type of thing requires a market capitalisation in bitcoin, and transaction volumes, many factors higher than we currently have , but given this is sorted, it is al quite logical. Infact what happens in a financial crisis where the USD starts to drop before the Chinese have got their money out? The USD could restrict capital flight in some ways and in that case they may be left with no other method to repatriate their funds.

The speculation is fun, and I don't see a reason why the government of China would want to go down a path of repressing the bitcoin technology. I think the anti-communist libertarian idea of bitcoin is not the full picture. Bitcoin and certainly blockchain like technologies are more suited to communist type thinking than the current financial system. Chinese people are very quick to integrate new technologies into thier lives and I think we should give them some respect.

Thursday 19 January 2017

Miners Revolt

As Theresa May makes nice speeches for the hard Brexit and still manages to feel as cold as Margeret Thatcher. And as people buy safe assets in the shadow of Trumps Inauguration, Bitcoins price is bouncing back to $900 after a serious pull back from all-time highs, Litle however, the nubies know, but we have a Miners Revolt in the mix.

Adoption of the new core code including Segregated witness has reached a plateau. This update to the software that runs bitcoin was expected to be picked up quickly by people running bitcoin nodes, but it appears many miners are hesitant to adopt it. The new technology increases the transactions that can be processed in a single block on the blockchain.

Miners, who get paid in part by transaction fees, see this as a pay cut. Yes, it's true, the block size debate is not yet dead. Increasing the block size would theoretically allow miners to make more from transaction fees which are oft6en paid by kilobyte rather than by transaction. Segwit however, allowing more transactions per kilobyte is simply seen as a permanent pay reduction,

Miners are in an extremely competitive game and don't want or need this kind of efficiency. Every little bit counts to get ahead of competitors. It has become so prolific that Bitcoins total mining computer power is more 100 times that of googles servers. Is this justified? Of note is the that miners still only make a small percentage less than 10% of their money through transactions. This transaction fee payment is set to increase until, somewhere around 2120, it makes up their total income.