Following the American presidential debates lately, you might realise how ridiculous its become. Polarised politics no longer conform to the norms of center, left and right. On the conservative side people are grabbing sound bites and boycotting debates strategically, Donald trump is not conservative enough, yet Sarah Palin calls him a "beer drinking, gun slinging redneck". On the democratic side people are criticising other leadership challengers for getting negative on people of there own party. People are straying from the for running contender Hillary Clinton, because she's not seen as anti establishment enough. The whole thing is a nightmare to watch. Politicians recite their strategic voter demographic policy points over and over. Finding a new thought towards progress is a rare occasion. Despite the thousands of questions we are just getting the same answers. It would be to much of a risk to veer from the campaign agenda. Many of the character involved have become parodies of themselves. It's is a sure sign that politics as a constructive part of a society moving forward is dead!

On the other hand crypto currencies are on the cusp of creating a political system that makes sense in the modern world. There is a leadership debate and a whole host of cohesive solutions developing and vying for popular approval. Its multi dimensional, people are debating the policy structure in its self. Miners are actively voting on their views and users are promoting there own agendas. The political developer structure in itself is evolving with multiple competing core like groups. On top of that once ad hoc political bitcoin groups are giving good clarification of their positions, clarifying the divisions of their existing power structure, and new alternative groups are immerging. The Bitcoin Unlimited group just release a detailed manifesto. It is substantial stuff, not sound bytes.

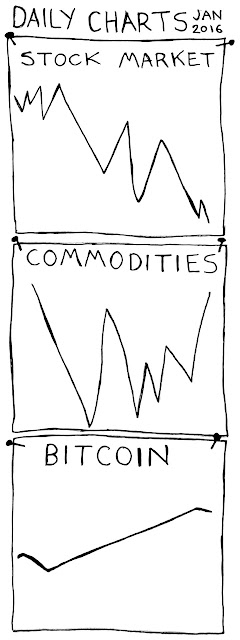

This has been catalysed by pressure built up naturally and over the last two months due to increasing transaction load on the network. Every detail of bitcoin governance is being discussed, scrutinised and progressed. With the escalating drama and media attention there has been a huge amount of progress in this area though some may stress not enough. The positive thing is that there are valuable ideas, creative solutions and actual actions taking place. Things that many people have lost faith in with politics around the world.

Funding is a common area of concern in both the American and the bitcoin political arenas. This is clearly more transparent in the bitcoin scene. Could this simply be caused by size, or is there something else. Is transparency allowed by crypto currency an integral part of our future democracies? Is there new value to be found in the optional participation model of governance in bitcoin? When you compare these two political universes we find a clearly less offensive solution in new models for cryptocurrency. We are all sick of these old guys babbling on about themselves. Old politics may be coming to an end.

On the other hand crypto currencies are on the cusp of creating a political system that makes sense in the modern world. There is a leadership debate and a whole host of cohesive solutions developing and vying for popular approval. Its multi dimensional, people are debating the policy structure in its self. Miners are actively voting on their views and users are promoting there own agendas. The political developer structure in itself is evolving with multiple competing core like groups. On top of that once ad hoc political bitcoin groups are giving good clarification of their positions, clarifying the divisions of their existing power structure, and new alternative groups are immerging. The Bitcoin Unlimited group just release a detailed manifesto. It is substantial stuff, not sound bytes.

This has been catalysed by pressure built up naturally and over the last two months due to increasing transaction load on the network. Every detail of bitcoin governance is being discussed, scrutinised and progressed. With the escalating drama and media attention there has been a huge amount of progress in this area though some may stress not enough. The positive thing is that there are valuable ideas, creative solutions and actual actions taking place. Things that many people have lost faith in with politics around the world.

Funding is a common area of concern in both the American and the bitcoin political arenas. This is clearly more transparent in the bitcoin scene. Could this simply be caused by size, or is there something else. Is transparency allowed by crypto currency an integral part of our future democracies? Is there new value to be found in the optional participation model of governance in bitcoin? When you compare these two political universes we find a clearly less offensive solution in new models for cryptocurrency. We are all sick of these old guys babbling on about themselves. Old politics may be coming to an end.