Translate

Sunday, 25 September 2016

Saturday, 3 September 2016

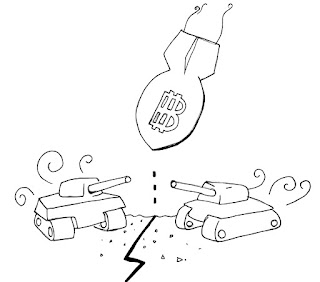

WW3 and Bitcoin

This is the internet, drama and conspiracy theories are rife. the best of us hold a healthy scepticism of all the things we read here. Votes by click power, however has got to have some merit when thinking about public opinion.

A common YouTube military theme is World War Three. Brazen comparisons between the US and the Chinese or Russian militaries and secret technologies are at the top of the list. On that theme I want to explore what might happen to Bitcoin, should these ideas have any truth to them.

Financial engineering is a major factor in large scale conflicts. Where the militaries of the USA and its proposed enemies might be similar in terms of soldiers and power the United States spends a lot more on maintaining its dominance than others spend. $597 billion as compared with China's $145 billion. This is currently sustained by the US in the face of large trade deficits (484b), government indebtedness(17trillion) and a lack of foreign reserves (125b). China for one is in almost the opposite situation with a trade surplus (293b) and huge reserves (3trillion). The USA is able to do this in essence, because of worldwide support, but the numbers are huge and baffling. When did we sanction all of this spending? You have to ask why we don't feed hungry people with this money instead and how long the USA will be able to use credit from the rest of the world, so called enemies included, to continue its military dominance?

It's a strange situation which there is no one clear answer, however should it all fall apart, or should a situation like world war three come to bet, the financial engineering will surely become a problem for the USA. What is an advantage now can certainly turn around in the future under very different and very stress WW3 conditions.

There is one solution however, drop the dollar completely! A radical solution to radical paranoid conspiracies, but a solution nonetheless. With technology like bitcoin, creating an impartial world currency, there is a quick way to make the debt problem go away. The USA could inflate away its financial issues, and when it comes to payback, simply switch to bitcoin. This would erase any imbalances. I'm not saying it will happen, nor would I want to endorse such crazy violence, but to all you war mongers conspirators out there, there might be a back up plan at the pentagon. Cryptocurrency could be the latest weapon in the futures dirty financial warfare.

A common YouTube military theme is World War Three. Brazen comparisons between the US and the Chinese or Russian militaries and secret technologies are at the top of the list. On that theme I want to explore what might happen to Bitcoin, should these ideas have any truth to them.

Financial engineering is a major factor in large scale conflicts. Where the militaries of the USA and its proposed enemies might be similar in terms of soldiers and power the United States spends a lot more on maintaining its dominance than others spend. $597 billion as compared with China's $145 billion. This is currently sustained by the US in the face of large trade deficits (484b), government indebtedness(17trillion) and a lack of foreign reserves (125b). China for one is in almost the opposite situation with a trade surplus (293b) and huge reserves (3trillion). The USA is able to do this in essence, because of worldwide support, but the numbers are huge and baffling. When did we sanction all of this spending? You have to ask why we don't feed hungry people with this money instead and how long the USA will be able to use credit from the rest of the world, so called enemies included, to continue its military dominance?

It's a strange situation which there is no one clear answer, however should it all fall apart, or should a situation like world war three come to bet, the financial engineering will surely become a problem for the USA. What is an advantage now can certainly turn around in the future under very different and very stress WW3 conditions.

There is one solution however, drop the dollar completely! A radical solution to radical paranoid conspiracies, but a solution nonetheless. With technology like bitcoin, creating an impartial world currency, there is a quick way to make the debt problem go away. The USA could inflate away its financial issues, and when it comes to payback, simply switch to bitcoin. This would erase any imbalances. I'm not saying it will happen, nor would I want to endorse such crazy violence, but to all you war mongers conspirators out there, there might be a back up plan at the pentagon. Cryptocurrency could be the latest weapon in the futures dirty financial warfare.

Bitcoin; The FUN Investment

I get the feeling when I watch the financial new these days, and when I see my friends talk to other people in the restaurant about there new experiences with bitcoin. One of the best things about bitcoin, is how it is an investment, yes it might be high risk, and YES it is exciting!

When you money doubles in 6 months it is great feeling', quality fun. It's hard to find an investment like this that is accessible to the masses, Bitcoin is. The price can go down too, you've got to be prepared for maybe 20% in a day, it can be shock, it makes you feel compelled to check on it regularly, it is all part of the intriguing drama. It is in this way that Bitcoin fills a serious savings niche.

Its become apparent that this niche is not so small. It's the a gap between straight up gambling in a casino, conservative savings accounts and putting gold in a safe. Its the middle class cash and what is becoming clear is that this is where most people are these days.

You might have money in some super fund doing nothing and boring you to death. If your in New Zealand, you might be unhappy to hear about how these funds have been investing in al sorts of unsavoury things and illegal thing. Nevertheless the money sits there in a kind of unhappy de-facto relationship. Most people don't have enough money to have shares or become angle investors in some highly lucrative exciting business like what Uber once was. Smaller online share services tend to have high fees and predatory tactics. Traditional brokers don't want to talk to you unless you have $25K to blow.

So when your saving for a house, a new car or a holiday, you just put your money in the bank and its even more totally boring (that is unless your bank goes bust). Instead you could put it in Bitcoin? If you had done that in the last six months you could have doubled your money! Beats zero interest. Not only that, but when you go on the holiday, you won't have to pay as many currency conversion charges!

If you have some spare money and you feel the need to make it big, if your one of the many unfortunate gabling addicts, instead of going to the casino why not just buy some bitcoin. Then you get a little bit of a fix, everyday! Even when the price of Bitcoin goes down it is a little fun to own, because you know that tomorrow you could hit the jackpot. It's like holding your hand for the next deal.

So as over the year bitcoiners, myself included, have been expelling energy convincing people of the soundness of the investment and of how volatility wasn't so intense and that it will recede with time. We come to the realisation that all the excitement is actually a good thing. Who wants a boring immoral elitist investment when you can have a wild one from accessible yet underground counterculture. Something more personalised to your way of thinking and your sense of life.

When you money doubles in 6 months it is great feeling', quality fun. It's hard to find an investment like this that is accessible to the masses, Bitcoin is. The price can go down too, you've got to be prepared for maybe 20% in a day, it can be shock, it makes you feel compelled to check on it regularly, it is all part of the intriguing drama. It is in this way that Bitcoin fills a serious savings niche.

Its become apparent that this niche is not so small. It's the a gap between straight up gambling in a casino, conservative savings accounts and putting gold in a safe. Its the middle class cash and what is becoming clear is that this is where most people are these days.

You might have money in some super fund doing nothing and boring you to death. If your in New Zealand, you might be unhappy to hear about how these funds have been investing in al sorts of unsavoury things and illegal thing. Nevertheless the money sits there in a kind of unhappy de-facto relationship. Most people don't have enough money to have shares or become angle investors in some highly lucrative exciting business like what Uber once was. Smaller online share services tend to have high fees and predatory tactics. Traditional brokers don't want to talk to you unless you have $25K to blow.

So when your saving for a house, a new car or a holiday, you just put your money in the bank and its even more totally boring (that is unless your bank goes bust). Instead you could put it in Bitcoin? If you had done that in the last six months you could have doubled your money! Beats zero interest. Not only that, but when you go on the holiday, you won't have to pay as many currency conversion charges!

If you have some spare money and you feel the need to make it big, if your one of the many unfortunate gabling addicts, instead of going to the casino why not just buy some bitcoin. Then you get a little bit of a fix, everyday! Even when the price of Bitcoin goes down it is a little fun to own, because you know that tomorrow you could hit the jackpot. It's like holding your hand for the next deal.

So as over the year bitcoiners, myself included, have been expelling energy convincing people of the soundness of the investment and of how volatility wasn't so intense and that it will recede with time. We come to the realisation that all the excitement is actually a good thing. Who wants a boring immoral elitist investment when you can have a wild one from accessible yet underground counterculture. Something more personalised to your way of thinking and your sense of life.

Sunday, 24 July 2016

The Invisible Wedge

There was a time when writers and philosophers thought of the industrial revolution as a beacon of hope for society. Eradicating poverty and oppression. Alvin Toffer writes about how a invisible wedge separates society in the transition from primitive to 'civilized' industrialised economy. I think we need to redefine what this word is about. Inspiring when thinking about crypto currencies, could this be part of the new Third Wave. Bitcoin is an invisible wedge of hope.

Saturday, 23 July 2016

When the Ancient Gems Were Found - A Bitcoin Analogy

After reading a Coinbase article, as many bitcoiners are drawn to do once in a while, I became inspired to write a kid friendly story to describe bitcoin. One where the essential function and structure of bitcoin is described in a basic form without mention of any modern technology. Something to fill in time at all of these two-year-old's birthday parties we seem to be invited to these days. A mystical legend.

In a land long ago the people of the land lived in many different villages around a big, tall mountain. The people would mainly stay in their own villages because it was easier that way. Some years some of the villagers would have a bad crop and go hungry whilst at the same time others would have more food than they could eat. People got jealous and there were many problems.

One day when searching for an answer to the troubles of the land, one of the villagers, Satoshi Nakamoto, climbed to the top of the mountain. He could see all the villages all around. At the very top of the mountain he found what he thought was a very special gem. It was very geometric and mathematical, not like any Gem that had ever been seen in the land. Satoshi sat on top of the mountain and thought about how this could help the people.

Satoshi saw his own reflection in the gem. This worried him. The people might get jealous of him or his village and this precious discovery if he kept it to himself and this would defeat the purpose. He wanted the solution to work for all the villages. He climbed slowly down the mountain with the biggest gem he could carry. He took the gem to another village where nobody knew his face and left it, wrapped in a note, on a path leading to the mountain. Then he went back up the mountain to get some more gems and mark the trail.

The villagers in the unknown village found the package and they got excited. A few of them took the path up the mountain to get some more. When they came back with Gems, more people saw it was real and did the same. It was a very steep and narrow path. Towards the top of the mountain it was not like a path at all, more like a ladder of stone, only one person could go up and down at a time.

Over time many villagers had the gems and they were trading with all the other villages. People from all the villages were climbing the mountain to get gems and the track got worn down. Holds of stone were polished by hand and feet, some broke off and it got more nd more difficult to climb. People could not carry as many gems down the mountain as they could at first. Only the best and most dedicated climbers could get more gems. they became very valuable. A piece of gem which you could once trade for a pizza from a friend could now buy a house.

Over time people started to race up the mountain. People got angry about it and many people still did not know about the gems, about how they held their history and about how they could be easily split. They knew little of the detailed history of the gems for all to see. They only recognised their value to trade. When they first discovered them they looked into the gems and the first thing they noticed was that some of the earlier villagers had big stashes of gems, collected in the days when climbing the mountain for new gems was not so risky or difficult. They envied the luck of the early villagers.

The majority of villagers called for a grand meeting, an appeal to change the mountain to make it more open for all. They wanted to have the same opportunity that the original villagers had. The first gem climbers did not agree, "before the mountain" they said, "your village was very rich whilst our village was hungry". Still the original villagers understood the struggle and wanted to help. They knew of the example of Satoshi's anonymous gift they had once found lying on the path.

The original villagers had become wealthy in their discovery, but the discovery was long ago now. They spent and gave away their spare gems to those who did the most good. They hid gems in exciting places. They felt good in the acts. In giving up their stash, they showed faith in themselves, that new opportunities would come and that they would be able to spot them. They were happy that the legacy of their generosity and their freedom from greed would be forever reflected in the history of the gems. For all to see, just like the first acts of Satoshi.

In a land long ago the people of the land lived in many different villages around a big, tall mountain. The people would mainly stay in their own villages because it was easier that way. Some years some of the villagers would have a bad crop and go hungry whilst at the same time others would have more food than they could eat. People got jealous and there were many problems.

One day when searching for an answer to the troubles of the land, one of the villagers, Satoshi Nakamoto, climbed to the top of the mountain. He could see all the villages all around. At the very top of the mountain he found what he thought was a very special gem. It was very geometric and mathematical, not like any Gem that had ever been seen in the land. Satoshi sat on top of the mountain and thought about how this could help the people.

The gem could be broken into smaller pieces easily and then moulded back together. if you looked into the gem closely, you could magically see its history and where it came from. The shiny reflections in the stone's translucent surfaces told the story of the stone's sharded history going back to when he first broke it from the tip of the mountain. After many days and nights of meditation and communication with gods and wizards, Satoshi decided the best use for the gem would simply be to trade with it. People all over the land would want it and it was hard to get, but the mountain was right in the middle of all the villages, it would be fair for all.

The villagers in the unknown village found the package and they got excited. A few of them took the path up the mountain to get some more. When they came back with Gems, more people saw it was real and did the same. It was a very steep and narrow path. Towards the top of the mountain it was not like a path at all, more like a ladder of stone, only one person could go up and down at a time.

Over time many villagers had the gems and they were trading with all the other villages. People from all the villages were climbing the mountain to get gems and the track got worn down. Holds of stone were polished by hand and feet, some broke off and it got more nd more difficult to climb. People could not carry as many gems down the mountain as they could at first. Only the best and most dedicated climbers could get more gems. they became very valuable. A piece of gem which you could once trade for a pizza from a friend could now buy a house.

Over time people started to race up the mountain. People got angry about it and many people still did not know about the gems, about how they held their history and about how they could be easily split. They knew little of the detailed history of the gems for all to see. They only recognised their value to trade. When they first discovered them they looked into the gems and the first thing they noticed was that some of the earlier villagers had big stashes of gems, collected in the days when climbing the mountain for new gems was not so risky or difficult. They envied the luck of the early villagers.

The majority of villagers called for a grand meeting, an appeal to change the mountain to make it more open for all. They wanted to have the same opportunity that the original villagers had. The first gem climbers did not agree, "before the mountain" they said, "your village was very rich whilst our village was hungry". Still the original villagers understood the struggle and wanted to help. They knew of the example of Satoshi's anonymous gift they had once found lying on the path.

The original villagers had become wealthy in their discovery, but the discovery was long ago now. They spent and gave away their spare gems to those who did the most good. They hid gems in exciting places. They felt good in the acts. In giving up their stash, they showed faith in themselves, that new opportunities would come and that they would be able to spot them. They were happy that the legacy of their generosity and their freedom from greed would be forever reflected in the history of the gems. For all to see, just like the first acts of Satoshi.

Saturday, 16 July 2016

My Open Bazaar Store

Time to sell stuff on Open Bazaar and retire. This is the killer app we have been waiting for. E-bay, trademe, amazon kiss my ass. Open Bazaar is here. Download bazaar Hound to browse and shop on your phone or the real app here. It easy and stylish. Look what i did in ten minutes! and the prices are so good. It's free!

Here's my store, I do air poluttion control:

f612c49c608b95b01e8443ddca74a0cf3275a948

Here's my store, I do air poluttion control:

f612c49c608b95b01e8443ddca74a0cf3275a948

Friday, 15 July 2016

Happy Bitcoin Halving Everyone!

Now is a time great time to get excited about bitcoin. Rumors about how the price would go down after the halving have been pretty much defunct. This psychological idea, based on the notion that traders had built the price up in anticipation is over and now the simple math can take over and the price is bound to rise.

Bitcoin miners will get half as many bitcoins for mining as they used to. It happens every 210,000 transaction blocks and it's a milestone for the network. The last time it happened, around 4 years ago, the price went up exponentially. Supply of new coins is reduced.

Whilst the Wall Street Journal does an article title "bitcoin miners get another pay cut" the reality of this is not as you might judge from this sentiment. The pay cut, is to a network which is in fact overblown. With more power than any other computer network by a factor of over one thousand fold. People don't need to feel regret for pulling back on this resource it is in-fact a conservation measure. Reducing the network incentive can also actually be a positive force of decentralisation. It can help little miners, the home miners, have long since given up on mining bitcoin, by shifting the balance in their favor. This can happen because of new efficient chip technologies are becoming available to the masses and existing miners are disrupted. Large miners with the current set ups will be stuck with their current equipment and may have to move from bitcoin into different crypto-currencies. In this way the bitcoin halving could also lead to a boom for other SHA256 crypto currencies. More decentralisation again.

Coins sharing the same mining algorithm as bitcoin tend not to be quite up to the standards of Litecoin and others that we are used to. It is a motley top 10, Zetacoin (ZET), Digitalcoin-SHA-256 (DGC), Mazacoin (MZC), Digitalcoin-SHA-256 (DGC), Terracoin (TRC), Titcoin (TIT), UniversalCurrency (UNIT), Curecoin (CURE), Freicoin (FRC), NeosCoin (NEOS), There are many more, I found 21 in total. They do have potential but it has been difficult to develop in this area due to risk of manipulation from powerful and unloyal bitcoin miners. They all have values that are a fraction of that of a bitcoin. If they are to gain a loyal mining base one of these coins now stand to become the second most powerful computer network in existence and along with it a significant currency.

As of now, price action seems pretty stable after the initial blip in bitcoin. This current relative stability is actually much like the last halving 4 years ago. the halving only lead to a huge price increase by building gradually over the following month.

If the bitcoin price doesn't do the same again then surely some altcoins will benefit from some of the extra hash power moving to them. Altcoin prices haven't yet seen any action and If they are up to it or deserving, is another question. Who would you choose out of the top ten? Digitalcoin seems to be taking the first step forward and seems quite reputable. Others like Freicoin do have some deep thinking economic concepts at hand.

This will be a very interesting space to watch. There's always a countdown here. Happy Bitcoin halving! I'm looking forward to many more halving parties to come. Will our next halving party be for an altcoin?

Bitcoin miners will get half as many bitcoins for mining as they used to. It happens every 210,000 transaction blocks and it's a milestone for the network. The last time it happened, around 4 years ago, the price went up exponentially. Supply of new coins is reduced.

Whilst the Wall Street Journal does an article title "bitcoin miners get another pay cut" the reality of this is not as you might judge from this sentiment. The pay cut, is to a network which is in fact overblown. With more power than any other computer network by a factor of over one thousand fold. People don't need to feel regret for pulling back on this resource it is in-fact a conservation measure. Reducing the network incentive can also actually be a positive force of decentralisation. It can help little miners, the home miners, have long since given up on mining bitcoin, by shifting the balance in their favor. This can happen because of new efficient chip technologies are becoming available to the masses and existing miners are disrupted. Large miners with the current set ups will be stuck with their current equipment and may have to move from bitcoin into different crypto-currencies. In this way the bitcoin halving could also lead to a boom for other SHA256 crypto currencies. More decentralisation again.

Coins sharing the same mining algorithm as bitcoin tend not to be quite up to the standards of Litecoin and others that we are used to. It is a motley top 10, Zetacoin (ZET), Digitalcoin-SHA-256 (DGC), Mazacoin (MZC), Digitalcoin-SHA-256 (DGC), Terracoin (TRC), Titcoin (TIT), UniversalCurrency (UNIT), Curecoin (CURE), Freicoin (FRC), NeosCoin (NEOS), There are many more, I found 21 in total. They do have potential but it has been difficult to develop in this area due to risk of manipulation from powerful and unloyal bitcoin miners. They all have values that are a fraction of that of a bitcoin. If they are to gain a loyal mining base one of these coins now stand to become the second most powerful computer network in existence and along with it a significant currency.

As of now, price action seems pretty stable after the initial blip in bitcoin. This current relative stability is actually much like the last halving 4 years ago. the halving only lead to a huge price increase by building gradually over the following month.

If the bitcoin price doesn't do the same again then surely some altcoins will benefit from some of the extra hash power moving to them. Altcoin prices haven't yet seen any action and If they are up to it or deserving, is another question. Who would you choose out of the top ten? Digitalcoin seems to be taking the first step forward and seems quite reputable. Others like Freicoin do have some deep thinking economic concepts at hand.

This will be a very interesting space to watch. There's always a countdown here. Happy Bitcoin halving! I'm looking forward to many more halving parties to come. Will our next halving party be for an altcoin?

Subscribe to:

Comments (Atom)