For cyberpunk fans the tv show Mr Robot is great, if you haven't seen it, get on it. Bitcoin and the concept of competing corporate crypto-currencies even feature in the plot. Despite this technical depth and alternative theme, it seems to have heaps of fans. It averaged 1.4 million views every week in America last year.

It makes you think about the growing level of awareness in society for bitcoin, and of current cultural preferences. With bitcoin still in its infancy as far as market capitalisation what is the real level of enthusiasts investment? Is there a whole lot of people who are currently into bitcoin theoretically, but not yet invested? With a market cap of around 10 billion USD what does this equate to per person? How many people are into bitcoin? Are we still early adopters?

Estimates I've read of how many people are using bitcoin range from a 1 or 2 million to 100 million people something more accurate would be useful. So it could be anything from $10,000 to $100 USD held per person on average. From my initial perspective, the higher number of users feels like it makes sense, considering the number of people I know with bitcoin. However taking the pessimistic stance might be a better choice.

In this case, what if every Mr Robot fan decided to buy one bitcoin? This would equate to an increase in investment of over 840 million USD, a pretty big number. This could make the price rise by a minimum of 8%. Not nothing, but if you take into account current daily exchange volumes, with a mean around 25 million USD. That day would theoretically make the "Mr Robot buy" put the price up, worst case scenario to... $20,760 USD. Crazy moon!!

These back of the envelope calculations are baffling. 1.4 million Mr Robot fans each buying new bitcoins in a day would certainly not be an insignificant event. Yet we haven't seen anything like this recently, why doesn't the social change convert to bitcoin price? It brings to mind a few ideas. Is bitcoin trading volume becoming a less significant part of its overall volume? Are bitcoin fans just not that into money?

With 1 million holders the average bitcoiner would have more than $10,000 USD worth of bitcoin. A number that seems quite high for a young computer punk. The value of bitcoin is supposed to be dispersed. It could be more like 2 or 3 million holders and It may even be that MR Robot fans already own bitcoin. The exact numbers must be in the block chain.

With further research on bitcoin wallet numbers we can find that there are currently 4,233,000 bitcoin wallets with a decently spendable amount of money in them. With around 3 million of those containing less than one bitcoin leaving about 1.2 million wallets with more than one coin. You can start to see why the 1 million holders assumption used above is reasonable and why "the Mr Robot buy" throughs up such big numbers. We can safely say that there are between 1 and 3 million bitcoin holders.

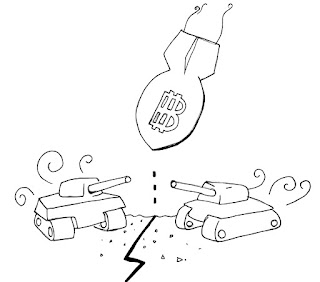

The math shows that we do in fact have a simple solution for toppling debt and "Evil Corp" issues we see on TV and in real life. Yet, for many old school crypto holders this is eye role material, Images of bear whales haunt our minds. We know most value held in bitcoin sits in wallets holding between 10-100 coins and we have been trying this for years. It seems that many of us are already in bitcoin to a high level and have become critical and pessimistic. We have taken a few hits and in a way we'd rather watch a show and dream about change than drop any more cash. A typical state for a bitcoiner, an atheist like distaste for self-promoting sermons. The truth is though that the corporate investors have not yet got to bitcoin and it is still accessible to masses of early adopters. If we just picked up our nerd sized investments and bought that one more coin, it might make all the difference.

So what will future episodes bring? It seems likely that the majority of people who would say they are "into bitcoin" don't actually own a significant amount. Are people afraid because of past criminal associations? Is the show an elaborate hoax distracting us from this truth? At what point do people reach maximum conspiracy theory saturation?

So let's get excited, if we do this will then lead to more interest and become a catalyst for change. We've got to understand that the 100 million odd potential bitcoin curious might actually just get angry at Evil Corp and buy bitcoins too. All of the sudden "Evil corp" would be left out of the picture. Hopefully we can read this and understand, that though it's confusing it doesn't have to be, and that popular culture is on board. If everyone stands by their morals and gets behind the concept, no elaborate hack is necessary. If you don't have bitcoin then why not vote against the establishment with your money and buy bitcoins. We can change the world. But we have to snap out of our stupor.The money will flip to those who participate in the new popular culture. Is real or is it a hallucination? Just like Elliot, underground bitcoiners are no longer so sure.

It makes you think about the growing level of awareness in society for bitcoin, and of current cultural preferences. With bitcoin still in its infancy as far as market capitalisation what is the real level of enthusiasts investment? Is there a whole lot of people who are currently into bitcoin theoretically, but not yet invested? With a market cap of around 10 billion USD what does this equate to per person? How many people are into bitcoin? Are we still early adopters?

Estimates I've read of how many people are using bitcoin range from a 1 or 2 million to 100 million people something more accurate would be useful. So it could be anything from $10,000 to $100 USD held per person on average. From my initial perspective, the higher number of users feels like it makes sense, considering the number of people I know with bitcoin. However taking the pessimistic stance might be a better choice.

In this case, what if every Mr Robot fan decided to buy one bitcoin? This would equate to an increase in investment of over 840 million USD, a pretty big number. This could make the price rise by a minimum of 8%. Not nothing, but if you take into account current daily exchange volumes, with a mean around 25 million USD. That day would theoretically make the "Mr Robot buy" put the price up, worst case scenario to... $20,760 USD. Crazy moon!!

These back of the envelope calculations are baffling. 1.4 million Mr Robot fans each buying new bitcoins in a day would certainly not be an insignificant event. Yet we haven't seen anything like this recently, why doesn't the social change convert to bitcoin price? It brings to mind a few ideas. Is bitcoin trading volume becoming a less significant part of its overall volume? Are bitcoin fans just not that into money?

With 1 million holders the average bitcoiner would have more than $10,000 USD worth of bitcoin. A number that seems quite high for a young computer punk. The value of bitcoin is supposed to be dispersed. It could be more like 2 or 3 million holders and It may even be that MR Robot fans already own bitcoin. The exact numbers must be in the block chain.

With further research on bitcoin wallet numbers we can find that there are currently 4,233,000 bitcoin wallets with a decently spendable amount of money in them. With around 3 million of those containing less than one bitcoin leaving about 1.2 million wallets with more than one coin. You can start to see why the 1 million holders assumption used above is reasonable and why "the Mr Robot buy" throughs up such big numbers. We can safely say that there are between 1 and 3 million bitcoin holders.

The math shows that we do in fact have a simple solution for toppling debt and "Evil Corp" issues we see on TV and in real life. Yet, for many old school crypto holders this is eye role material, Images of bear whales haunt our minds. We know most value held in bitcoin sits in wallets holding between 10-100 coins and we have been trying this for years. It seems that many of us are already in bitcoin to a high level and have become critical and pessimistic. We have taken a few hits and in a way we'd rather watch a show and dream about change than drop any more cash. A typical state for a bitcoiner, an atheist like distaste for self-promoting sermons. The truth is though that the corporate investors have not yet got to bitcoin and it is still accessible to masses of early adopters. If we just picked up our nerd sized investments and bought that one more coin, it might make all the difference.

So what will future episodes bring? It seems likely that the majority of people who would say they are "into bitcoin" don't actually own a significant amount. Are people afraid because of past criminal associations? Is the show an elaborate hoax distracting us from this truth? At what point do people reach maximum conspiracy theory saturation?

So let's get excited, if we do this will then lead to more interest and become a catalyst for change. We've got to understand that the 100 million odd potential bitcoin curious might actually just get angry at Evil Corp and buy bitcoins too. All of the sudden "Evil corp" would be left out of the picture. Hopefully we can read this and understand, that though it's confusing it doesn't have to be, and that popular culture is on board. If everyone stands by their morals and gets behind the concept, no elaborate hack is necessary. If you don't have bitcoin then why not vote against the establishment with your money and buy bitcoins. We can change the world. But we have to snap out of our stupor.The money will flip to those who participate in the new popular culture. Is real or is it a hallucination? Just like Elliot, underground bitcoiners are no longer so sure.